Branch information, including lobby and drive-up hours, can be found on Contact Us.

My Account Details & Statements

-

How can I update and verify my contact information?

It’s easy and quick to update and verify your info. Follow these simple instructions for Online Banking (desktop) or Mobile App (iOS or Android).

Mobile App (iOS)

1. Log in to the Mobile App

2. Go to More

3. Go to Others

4. Go to Settings

5. Go to Contact

6. Add or update your phone numbers, email address and preferences

7. Confirm your phone number by answering the security questions or entering a code from your emailMobile App (Android)

1. Log in to the Mobile App

2. Go to the hamburger menu (three lines in the top left)

3. Go to Settings

4. Go to Contact

5. Add or update your phone numbers, email address and preferences

6. Confirm your phone number by answering the security questions or entering a code from your emailOnline Banking

1. Log in to Online Banking

2. Go to Settings (top right)

3. Go to Contact

4. Add or update your phone numbers, email address and preferences

5. Confirm your phone number by answering the security questions or entering a code from your email -

How can I update my email or street address?

- Log in to our mobile app1 or online banking

- Click Settings, then Contacts

- Change your personal information

-

When will I get my statement?

You will receive monthly statements if you have an active checking account or loan. Otherwise, you will receive quarterly statements. The statement cycle runs from the first day of the month to the last day of the month. If you’re enrolled in e-statements, you’ll receive an email when your e-statement is available.

-

How do I access e-statements?

You can access your e-statements by clicking on the eDocs widget in online banking.

-

How many months of e-statements will there be in my e-statement library?

Once you enroll in e-statements, your e-statement library will store the last 24 months’ worth of e-statements.

-

How do I add my card to my mobile wallet?

Click on your device for instructions to add your card to your mobile wallet.

Managing My Money

-

Does my checking account provide overdraft protection options?

Yes. ACFCU can cover overdrafts in two different ways:

- Courtesy Pay3 – If you qualify, you are automatically opted in. You can opt out via the Courtesy Pay Widget in the Mobile App1 and Online Banking.

- Overdraft Transfer – Such as a link to another account.

Courtesy Pay covers the following types of transactions:4

- Checks, ACH and other transactions made using a checking account

- Automatic bill payments

- Recurring transactions set up using your debit card

- ATM transactions

- Everyday debit card transactions

- Point of Sale (POS) transactions

We also offer a $30 grace allowance. That means no fees for debit card transactions if your overdrawn balance is less than $30.2

The Fine Print

1Data rates may apply.

2This only applies to debit card transactions. ACH transactions do not have the $30 grace before a fee is charged.

3Overdraft fees must be repaid within 45 days. A $30 fee is charged for each occurrence.

4ATM transactions, everyday debit card transactions, and Point of Sale (POS) transactions require separate opt-in.

5Apple, the Apple logo, iPhone and iPad are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc. Data charges may apply.

-

How do I set up automatic deposits or withdrawal for my ACFCU account with an outside party?

If you have electronic payments, withdrawals or deposits being made to your account from a merchant or other financial institution (like payroll deposits or utility bill payments), notify that merchant or institution of your account number and ACFCU’s ABA routing number: 256078404.

-

How do I manage automatic deposits or withdrawals from my ACFCU account?

You can transfer between your ACFCU account and external accounts for free (subject to a fee for insufficient funds) by following these easy steps:

1. You’ll need:

- The routing number of the other financial institution

- Your account type and number

- Access to your ACFCU online and/or mobile banking

2. Follow the instructions on our step-by-step ACH Origination Setup guide.

- Same-day transfers before 2 p.m. (EST) on valid business days, otherwise it will appear on the next business day

- Each transfer to or from your savings account will count toward monthly transaction limits

- Cancel pending transfers under the Scheduled Transfers feature

-

Do you offer wire transfers?

Yes, to wire money to your ACFCU account, simply provide the other institution with these instructions:

Incoming Wires

- Wire to: Arlington Community Federal Credit Union, ABA# 256078404

- Credit to: Your name and your 13-digit account number (found on the bottom of your checks or via online banking)

Outgoing Wires

- Can be requested online, in person, and via fax or email

-

How do I set up electronic alerts for loan payments?

- Log in to Online Banking

- Click on your name in the top right corner

- From the drop-down menu click SETTINGS

- Click NOTIFICATIONS

- Under Accounts, click the SETTINGS icon to the right of Loan Payment Due Date

- Slide the button to ON

- Click SELECT AN ACCOUNT

- Choose the Loan(s) and then choose the number of DAYS before and after the Due Date to receive an alert

- Click SAVE

- Click the box to indicate which method to receive alert: EMAIL and/or MOBILE

- Click SAVE CHANGES

To modify an Alert, follow the instructions above.

To delete an Alert, follow steps 1-6 and slide the button to OFF.

-

What are the requirements when creating a username for Online and Mobile Banking?

Usernames must be alphanumeric and between eight and 15 characters. Old usernames cannot be reused.

Agreements, Fees and Penalties

-

How can I review Arlington Community Federal Credit Union’s Privacy Policy?

You can access our Privacy Policy online at any time.

-

How can I avoid ATM fees?

There are three ways to avoid the ATM fees:

- Use a fee-free Arlington Community FCU ATM

- Open a Free Rewards Checking Account and meet the monthly qualifications to have up to $10 in ATM fees refunded monthly

- Use one of nearly 30,000 Co-Op Network ATMs

- What are your fees and when are they assessed?

-

How can I avoid paying the $5 monthly balance maintenance fee or Express Fee?

You can avoid the monthly maintenance fee three ways:

1. Maintain a combined loan and deposit amount of $1,000

2. Actively use a Free Rewards Checking Account

3. We waive the fee for members under age 21 or over age 55

-

Is there a penalty for paying off my loan early?

No, we don’t penalize you for paying off loans early. If we paid any fees on your behalf for closing the loan or provided a cash back incentive, those amounts must be paid back if you close your loan within 36 months of opening the loan. The amount owed will be included in your loan payoff amount.*

The Fine Print

*If loan is paid off within 36 months of opening, the cash back or closing costs may be added to the pay off amount.

Free Rewards Checking Account

-

When will I receive my debit card?

Mail: 7-10 business days

In-person: Instant issue option

-

When will I start to earn rewards on my account?

Eligible to start accumulating transactions right away (right after checking account has been opened or converted from a basic checking) and the rewards are applied to the account at the end of the month. If the checking account is closed before the end of the month, then the reward is not applied. Member can use the rewards check-in widget in OLB and mobile app to track their progress.

-

What if I overdraft my account?

Overdrafts won’t impact rewards.

Can overdraft account:

- Courtesy Pay1

- Overdraft Transfer

The Fine Print

1Overdraft fees must be repaid within 45 days. A $30 fee is charged for each occurrence.

-

Are there any fees or minimum balance requirements?

None for the Free Rewards Checking. Basic Checking may be assessed the express fee if requirements are not met.

-

I’m ready to open a checking account. Where do I begin?

Brand new members: Can open in person at the branch or online.

Existing members: Can open in person at the branch, online, or over the phone at 703.526.0080 x4.

Personal Loans

-

What are the requirements to apply for a personal loan?

You must be a member or qualify for membership in ACFCU and your membership must be established before any loan can be issued.

-

How much can I borrow with a personal loan?

We offer personal loans from $1,000 to $50,000, subject to credit and income qualifications.

-

What can a personal loan be used for?

Just about anything! Personal loans are great for consolidating debts or financing a household expenses at a lower interest rate than a credit card.

- What is the process of applying for a personal loan?

-

When will I receive the funds from my personal loan?

Once your application is approved and any supporting documents (such as verification of your income, if needed) have been provided, you can sign your loan documents electronically and have the funds in a matter of hours.

-

What type of collateral do I need to provide for a personal loan?

Personal loans do not require collateral; however, if you do have collateral, like a paid-off vehicle, you may be able to qualify for a larger loan at a lower rate using your collateral.

-

Is there an advantage to paying off my loan faster?

Yes! You are welcome to make larger or additional payments at any time. There is no penalty for paying early and you’ll save money in interest over the life of the loan. Just remember that you have to make each scheduled payment when it is due, even if you previously made a larger payment.

-

Do you offer payment protection?

Yes, we offer convenient and affordable payment protection options that protect you and your loved ones in the event of disability or death of a covered borrower.

Mortgages and Home Equity

-

What should I do before applying for a mortgage?

Applying for a new mortgage or refinancing your current one? Reference this convenient mortgage application checklist to find out what forms you need to keep the process moving.

-

How can I understand the terms better?

Don’t know your amortization from your recission? No worries! Our glossary of mortgage terms will break down everything you need to know and help you sound like a pro.

-

Do you know any mortgage application tips?

We’ve compiled our top 10 tips when applying for a mortgage to help make you a strong applicant so you can finance your dream home.

-

How can I understand the process better?

Buying or refinancing a home can feel overwhelming and confusing, but with our guide to understanding the mortgage process, it doesn’t have to be.

-

What should I do before I apply for a home equity loan or line?

Prepare to complete your home equity loan application by ticking the boxes on our home equity application checklist.

-

How do I request a Subordination Agreement?

Requesting a Subordination is easy, follow the steps in the subordination agreement instructions.

-

Where can I find answers to my home equity payment and statement questions?

Get fast answers to all of your most pressing home equity questions in our FAQ payment and statements guide.

-

How do I access my line of credit?

Understanding how to access your home equity line of credit has never been easier with our FAQ accessing line of credit guide.

*This applies to both consumer and equity loans.

Savvy Money

-

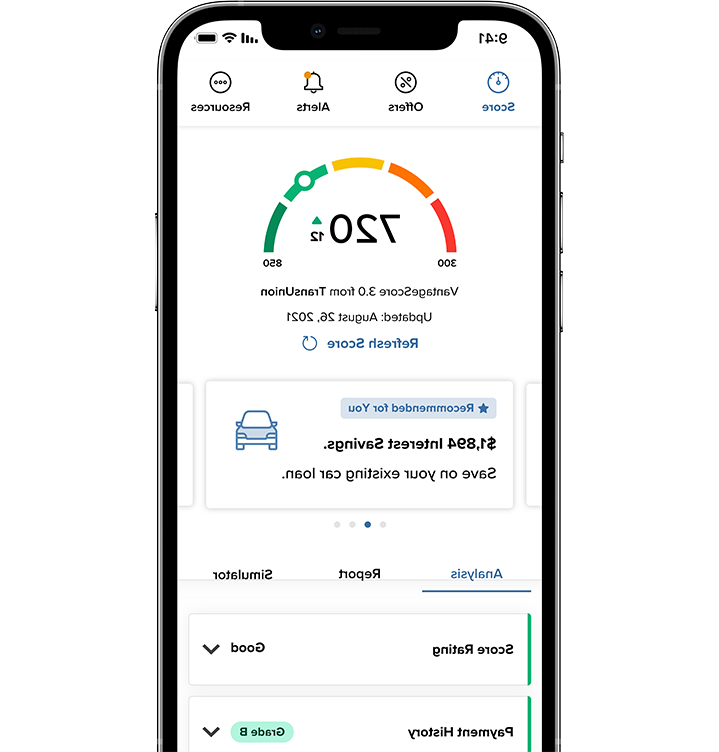

Is Savvy Money free?

Yes! Savvy Money is a free service available in Online Banking and Mobile.

-

Will enrolling or accessing Savvy Money affect my credit and potentially lower my score?

No! Checking credit scores on Credit Score is a “soft inquiry” that does not affect credit score.

-

What scoring model does Savvy Money use?

Vantage 3.0

Please note that Vantage Score and FICO scores may be different and may result in different credit tiers/rates.

-

What bureau does Savvy Money pull credit profiles from?

TransUnion

-

How is my privacy protected through this credit monitoring service?

To enroll, you first must be logged in to our secure online banking or mobile platform. Your credit information is never shared with third parties.

-

Can the credit score in Savvy Money differ from other credit monitoring apps or loan applications?

Yes. Three major credit reporting bureaus—Equifax, Experian, and Transunion—and two scoring models—FICO or VantageScore—determine credit scores. Financial institutions/lenders use different bureaus, as well as scoring models. Over 200 factors of a credit report may be considered when calculating a score, and each model may weigh credit factors differently. Hence, no scoring model is completely identical but should directionally be similar.

-

Why is my credit score different in Credit Score than the score on my loan application?

Savvy Money is a credit monitoring tool we provide to you at no cost to learn more about how your financial decisions impact your credit score. You can expect your score to be different because we consider additional credit factors in your loan application that are not available in this tool that may result in a different score.

Credit monitoring tools like Savvy Money use scoring models like Vantage Score 3.0 to display your credit details. There are additional credit factors we consider when reviewing your loan application by using a FICO scoring model. The use of different scoring models is why you see a difference in your scores.

No scoring models are identical but are directionally the same. If your score goes up based on your credit activity in Savvy Money, you might see an increase in the scores we pull for loan applications as well.

-

What if I see an error on my credit report?

If you find incorrect information in your credit report, contact the company that issued the account or the credit reporting company that issued the report.

There is also more information on how to resolve these types of issues in the FAQ section under Resources.

-

Can I download my credit report in Savvy Money?

Yes! On the Credit Report page, click “Download Report” in the top right corner.

-

When does my status change to inactive in Savvy Money?

If you do not log in to online or mobile banking for 120 days, your Money Savvy will go inactive, and you will be unenrolled. To re-enroll, follow the normal enrollment procedures to regain access to your profile information.

-

Can I unenroll from Savvy Money?

Yes. On the Resources tab, select “Profile Settings”, scroll to the very bottom and select “Deactivate Credit Score Account.” Once unenrolled, you can choose to reenroll at any time through online or mobile banking.

-

Can I receive alerts from Savvy Money?

You can receive credit alerts, monthly notices, and general messages from Credit Score.

-

Can I turn off email notifications from Credit Score?

Yes. You can manage your email notifications by navigating to the Resources Tab, selecting “Profile Settings”, and changing their preferences under Email Notifications. You can also change your subscription settings at the bottom of emails you receive.

-

Who responds to the questions Contact Us option?

Savvy Money will answer general questions related to credit scores and their site. Any specific credit union questions will be redirected to our Digital Banking team.

Business ACH

-

How does ACH Work?

- Originator: The individual or organization initiating the transaction.

- ODFI (Originating Depository Financial Institution): The Originator’s bank that forwards the transaction into the ACH network.

- ACH Operator: Processes transactions between different financial institutions, such as The Federal Reserve Bank (FedACH).

- RDFI (Receiving Depository Financial Institution): The bank that receives the transaction and credits or debits the Receiver’s account.

- Receiver: The individual or organization receiving the funds.

Business Credit Cards

-

Can I make transfers out of my main credit card account?

No, that main credit card is a holding place for the funds. To make transfers you must go to the Transfers screen, select the credit card as the “From” account and then select a share for the “To” account.

-

What is a business cardholder?

The business cardholder has an assigned credit card given to them by the Business Administrator. They cannot request a limit increase, report a card lost or stolen, etc. Any maintenance requests must be submitted by the Guarantor. If you are the guarantor, please contact card holder services at 800-637-7728.

-

How do I file a dispute?

Only the Guarantor can file a dispute. They will need to contact Card Holder Services at 800-637-7728.

-

How do I file a fraud claim?

Only the Guarantor can file a fraud claim. They will need to contact Card Holder Services at 800-637-7728.

-

How do I set up my PIN?

Call PIN now at 800.631.3197, enter EIN and business phone number.

-

Will I see my business credit card when I login using my personal account credentials?

No, personal accounts will remain separate from business accounts.

-

What is the due date on my business credit card?

On the 25th of the following month.

-

How do I make payments on my business credit card?

- Online transfers from a Business Checking account to the Control Card.

- Mail a check to cardholder services – address found on statement.

- Visit a branch to make a payment.

-

How do I enroll for e-statements?

1. Log in to your online banking account from your computer and go to the eDocs widget

2. Click on Overview

3. Click on the subscriptions setting caret: V

4. Click on the gear wheel

5. Select subscribe!

-

Why does my credit card say that my balance is zero when there is a balance?

In your online view, you can see your transactions only. The Business Administrator has access to view all of the transaction history and balances for all cardholders.

-

How do I dispute a charge?

Contact your Guarantor.

-

How do I order a replacement card?

Contact your Guarantor.

-

How do I reset my online access?

Contact your Business Administrator to unlock your online access.

Why Remarkable Service

is Right For You

As a full-service credit union, we’re a cooperative of members like you who know that by coming together, we can all benefit in our financial journey.

Financial Empowerment

We’re here to help our members—and neighbors—meet their financial goals and live their best lives.

Rewarding Experience

We think there’s nothing more rewarding than serving our members—and believe one good turn deserves another.

Utmost Integrity

We not only meet your financial needs, we commit to being a good neighbor and serving with integrity.